Remember when your savings account actually paid you decent interest? Yeah, me neither.

These days, most of us are watching our cash sit in bank accounts earning a measly 0.5% while inflation quietly eats away at our purchasing power. You work hard for your money, but your money isn’t working hard for you.

There’s actually a way to earn 4-5% on your cash right now. It’s safe, backed by the US government, and you can start with as little as $100. I’m talking about tokenized treasuries – essentially US Treasury bonds that have been digitized and made accessible through blockchain technology.

Think of it as getting VIP access to the same stable investments that big institutions use to park their billions. You can buy, sell, or check your balance 24/7 from your phone.

In this guide, I’ll walk you through exactly what tokenized treasuries are, how they work, and most importantly, how you can use them to finally earn meaningful yield on your cash. We’ll cover the major platforms, safety features, and the step-by-step process to get started.

Let’s turn that lazy cash into productive capital.

What Are Tokenized Treasury Bonds?

Tokenized treasury bonds are simply US Treasury bonds that have been converted into digital tokens on a blockchain.

First, what’s a US Treasury bond? Think of them as IOUs from the US government. When you buy one, you’re lending money to Uncle Sam. In return, the government promises to pay you back with interest. These are considered the safest investments on the planet because the US government has never defaulted on its debt and can literally print money if needed.

Traditionally, buying Treasury bonds requires at least $10,000, dealing with clunky government websites, and having your money locked up until maturity. This is where tokenization changes everything.

Imagine you want to buy a slice of pizza, but the restaurant only sells whole pizzas for $100. That’s traditional Treasury bonds. Now imagine a friend buys the whole pizza and sells you individual slices for $10 each. That’s tokenization.

When Treasury bonds are tokenized, large financial institutions buy millions of dollars worth of actual Treasury bonds. They then create digital tokens on a blockchain that represent ownership shares of these bonds. Instead of needing thousands to get started, you can buy tokens worth $100 or even less.

You get the same safety of US government backing and similar yields, but with way more flexibility and accessibility. Your tokens live on the blockchain, meaning you can trade them 24/7 and see your balance in real-time.

Why Institutions Are Rushing Into Tokenized Treasuries

BlackRock, the world’s largest asset manager with $10 trillion under management, launched their own tokenized treasury product in 2024. Franklin Templeton, Ondo Finance, and dozens of other major players are all racing to tokenize Treasury bonds. The market has grown from basically zero in 2023 to over $2 billion by late 2024.

For institutions, it’s all about efficiency. Traditional Treasury settlement takes 1-2 business days. Tokenized treasuries settle instantly, 24/7. Banks can move billions without waiting for business hours and reduce operational costs by 80%.

Why this matters to you: when big institutions adopt something, it becomes legitimate, regulated, and accessible. These aren’t fly-by-night crypto projects. These are established financial giants building infrastructure that will last decades. That means better platforms, more competition (lower fees for you), and regulatory clarity that protects your investments.

The rush of institutional money also means yields stay competitive. These platforms need to attract capital, so they pass through nearly all the Treasury yield to you. No more banks taking a huge cut of your interest.

How Tokenized Treasuries Actually Work

Let me walk you through exactly how your money becomes a tokenized treasury and starts earning yield.

Step 1: Real Treasury Bonds Are Purchased

A platform like Ondo Finance takes millions of dollars and buys actual US Treasury bonds from the government. These are real bonds, not derivatives.

Step 2: Secure Custody

The bonds are held by regulated custodians like BNY Mellon or State Street. These custodians hold trillions in assets for major institutions. The bonds are segregated, meaning if the platform goes bankrupt, creditors can’t touch them.

Step 3: Token Creation

The platform creates digital tokens on a blockchain (usually Ethereum) that represent fractional ownership of the Treasury bonds. If they bought $10 million in bonds, they might create 10 million tokens worth $1 each.

Step 4: Purchase

You complete KYC verification and buy tokens using USD or stablecoins like USDC. When you buy 100 tokens for $100, you own a proportional share of the underlying Treasury bonds.

Step 5: Earning Yield

As the Treasury bonds earn interest, that yield flows to you. Some platforms distribute this daily, others monthly. It might come as more tokens or as stablecoins deposited to your wallet.

Step 6: Liquidity

Need your money back? Sell your tokens on the platform’s marketplace or redeem them directly for USD/USDC. Unlike traditional bonds where you might take a loss selling early, many tokenized treasury platforms let you exit at par value plus accrued interest.

Major Platform Examples:

Ondo Finance offers:

- OUSG: Direct Treasury tracking for accredited investors

- USDY: Retail-friendly “yield-bearing stablecoin” backed by Treasuries, $100 minimum

BlackRock’s BUIDL requires $100,000 minimums but other platforms are building on top of it, making it accessible to retail investors indirectly.

Yields: Tokenized Treasuries vs Traditional Options

Here’s what you’re actually earning across different “safe” options in 2025:

Traditional Savings Account: 0.5-1%

Your neighborhood bank pays almost nothing. On $10,000, that’s $50-100 per year.

High-Yield Savings Account: 3-4%

Better, but rates fluctuate and some have balance limits.

Traditional Treasury Bonds: 4-5%

Great yield, but high minimums and locked funds.

Money Market Funds: 4-5%

Similar yields but accessing money takes 1-2 business days.

Tokenized Treasuries: 4-5%

Same yield as traditional treasuries with $100 minimums and 24/7 access.

The key insight: tokenized treasuries give you the SAME yields with massively better accessibility. You’re not getting rich earning 5% annually, but on $10,000, that’s $500 per year instead of $50 from your savings account.

Plus, many tokenized treasury platforms compound your yield automatically. That 5% annual becomes 5.12% with daily compounding.

Safety and What Backs These Tokens

Your money has multiple layers of protection:

Level 1: US Government Backing

At the core, you own Treasury bonds backed by the full faith and credit of the US government. The US has never defaulted in 250 years.

Level 2: Regulated Custodians

The bonds are held by custodians like BNY Mellon, institutions that custody trillions and are heavily regulated.

Level 3: Audited Smart Contracts

Smart contracts are audited by multiple security firms. Major platforms have never had security incidents.

Level 4: Platform Compliance

Major platforms are registered with regulators. Ondo is SEC-registered. This isn’t the Wild West of early crypto.

Common Concerns:

“What if the platform fails?”

The bonds are held separately by the custodian. There’s a legal process to get token holders their money back.

“What if there’s a smart contract bug?”

This is the main tech risk. But major platforms have insurance, audits, and bug bounty programs.

“Is this FDIC insured?”

No, but Treasury bonds are arguably safer than FDIC insurance. Treasury bonds are backed by the government that backs the FDIC itself.

Risk hierarchy:

- Safest: Direct Treasury bonds

- Slightly less safe: Tokenized treasuries (same bonds + minimal tech risk)

- Less safe: Bank savings (FDIC only covers $250k)

- Much less safe: Corporate bonds, stocks, crypto

How to Actually Invest in Tokenized Treasuries

Ready to put your money to work? Here’s your roadmap.

STEP 1: Choose Your Platform

For US retail investors, Ondo Finance’s USDY is the easiest starting point with low minimums and a simple process.

STEP 2: Complete KYC Verification

Regulations require identity verification. You’ll need:

- Government-issued ID

- Proof of address

- Social Security Number (US residents)

Takes 5-10 minutes. Approval can be instant or take up to 48 hours.

STEP 3: Fund Your Account

Most platforms accept USDC (a stablecoin pegged to the dollar). Easiest path:

- Create a Coinbase account

- Connect your bank

- Buy USDC (1 USDC = 1 USD)

- Send USDC to your wallet

Some platforms now accept direct bank transfers. Start with $100-500 for your first purchase.

STEP 4: Buy Treasury Tokens

Once funded and verified:

- Connect your wallet to the platform

- Enter investment amount

- Confirm transaction

- Pay gas fee (usually $5-20)

Your tokens appear within minutes.

STEP 5: Track Your Yield

Platforms distribute yield differently:

- Daily token additions

- Increasing token value

- Monthly USDC payments

Check the platform’s dashboard for real-time earnings. Most automatically reinvest for compound growth.

STEP 6: Exit When Needed

Two options:

- Instant: Sell on marketplace at market price

- Redemption: Request from platform (1-7 days) for guaranteed full value plus interest

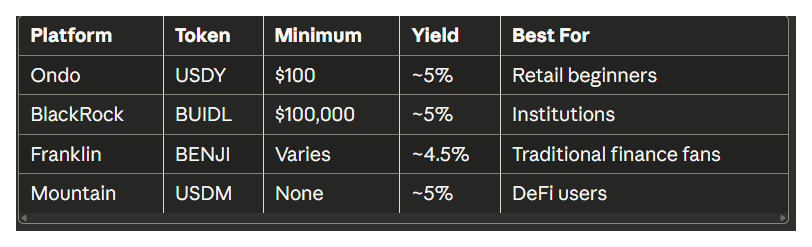

Major Platforms Offering Treasury Tokens

Ondo Finance is the sweet spot for beginners with USDY – a yield-bearing stablecoin that’s simpler than pure tokenized treasuries.

BlackRock BUIDL provides the infrastructure many other platforms build on.

Franklin Templeton brings 75+ years of traditional finance credibility.

Tax Treatment: What You Need to Know

The IRS likely treats tokenized treasury income as interest income. This means:

- Federal income tax on yield

- Usually exempt from state and local taxes

- You’ll receive 1099-INT or similar forms

Track everything. Every yield payment, every transaction. Some platforms provide tax reports, but keep your own records.

IMPORTANT: I’m not a tax professional. Consult a CPA who understands both crypto and securities. Tax law around tokenized assets is still evolving.

Who Should Invest in Tokenized Treasuries?

GOOD FIT FOR:

- Cash sitting in low-yield savings

- Crypto holders wanting stable yield

- Beginners entering RWAs safely

- Emergency funds needing liquidity

- Conservative investors comfortable with basic crypto

NOT FOR:

- High-return seekers (this is 5%, not 50%)

- Zero technology risk tolerance

- Those unwilling to learn crypto basics

- Non-US investors (many restrictions apply)

Think of them as replacing your savings account or money market fund – the safe, liquid portion of your portfolio. For conservative investors, 5-20% allocation makes sense.

The Future of On-Chain Fixed Income

Within 5 years, your brokerage account will offer tokenized treasuries alongside traditional ones. You won’t even know they’re on blockchain – just better access and settlement.

Major banks all have tokenization teams. The SEC is providing clarity. The Treasury Department is even considering issuing bonds directly on-chain.

By learning about tokenized treasuries now, you’re ahead of the curve. This will be as normal as online banking, but today you’re an early adopter getting better technology.

Final Thoughts

Tokenized treasuries aren’t going to make you rich overnight. But they’re a reliable way to earn meaningful yield on your cash when traditional banks give you peanuts.

They bridge the old financial world and the new. You get US Treasury bond safety with blockchain efficiency.

If you’ve been watching crypto from the sidelines, this is your entry point. Start with $100, learn the ropes with the safest possible asset.

Your action steps:

- Research platforms (start with Ondo’s USDY)

- Complete KYC verification

- Start with a test amount

- Learn by doing

- Scale up as comfortable

The traditional financial system is moving on-chain. Make sure you’re not left behind.

Explore more real-world assets with our RWApedia guides on tokenized real estate, carbon credits, and commodity tokens.

Leave a Reply