Table of Contents

Introduction

Imagine waking up to a detailed report showing your personal AI investment manager independently rebalanced your real estate portfolio overnight—selling an underperforming property and buying a higher-yield rental across multiple platforms. This isn’t science fiction. It’s the emerging intersection of artificial intelligence and Real-World Assets (RWAs)—things like real estate, art, or commodities that are divided into digital shares (tokens)—on the blockchain.

Today’s RWA investing is incredibly promising, allowing global access and liquidity. However, it’s complex. Managing these investments requires juggling multiple dashboards, tracking diverse rental income streams, and handling complex tax rules across different locations and digital platforms. Serious investors can spend 15–20 hours monthly just managing portfolios across platforms like Lofty, RealT, and Reental.

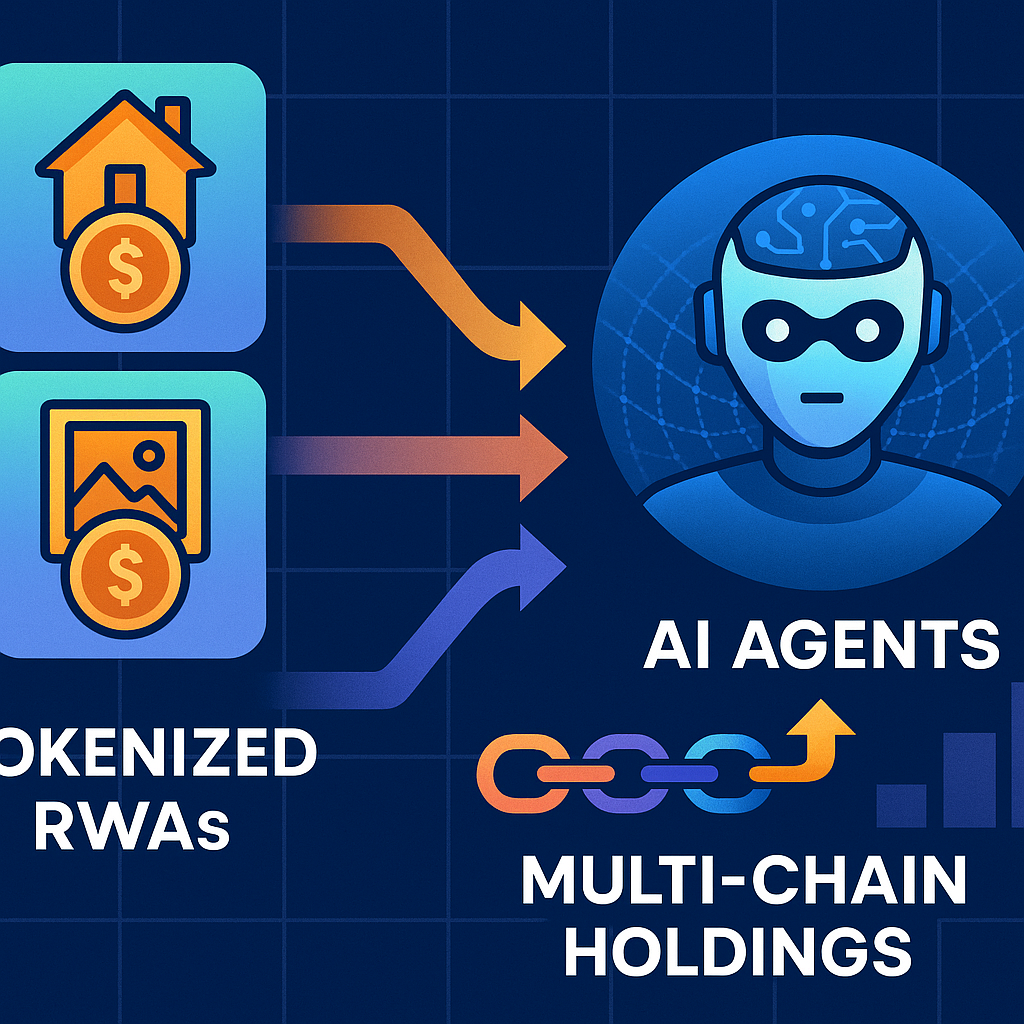

AI agents, like those being built on the Warden Protocol, are set to change this. This new, specialized computer network (a Layer 1 blockchain) integrates AI agents capable of autonomous, verifiable execution of investment decisions, helping investors securely automate and optimize their RWA portfolios. Warden’s mainnet launched in Q3 2025, bringing this vision closer to reality.

What Are AI Agents and Why They Matter?

AI agents are smart, autonomous programs—digital workers—that observe data, make decisions, and act independently on the blockchain. Unlike simple fixed-rule bots that can only follow rigid commands (“if X, do Y”), AI agents learn from data, analyze market trends, and adapt to complex situations—like scanning social media and economic indicators alongside digital transaction history (on-chain information).

Given the 24/7 nature of crypto markets and fragmented platforms, AI agents enable real-time monitoring, faster decisions, and automation of tedious tasks, dramatically reducing the workload and time commitment for the investor. For the everyday person, this means a massive reduction in the manual headache of owning complex assets that require constant oversight.

The Challenges of Managing RWAs Today

Managing Real-World Assets (RWAs) is notably harder than typical crypto trading because of several unique pain points:

- Multiple platforms have distinct interfaces, wallets, and rules.

- Real-world factors like tenants, maintenance, and local markets influence performance.

- Tax accounting is complex, involving rental income, capital gains, and multiple jurisdictions.

- Illiquidity means assets can’t be quickly sold like traditional stocks or simple crypto tokens.

- Due diligence (researching each property) demands extensive time.

An active RWA investor with $5,000 spread across 20 properties on 3 platforms typically spends a total of 50–80 hours per year on portfolio management alone. AI agents become not just helpful, but necessary as portfolio size and complexity grow.

How Warden Protocol Makes a Difference

Warden Protocol is a specialized, new computer network (a “Layer 1” blockchain) built specifically to run these smart AI agents.

Key innovations that overcome fragmentation and build trust include:

- SPEX (Statistical Proof of Execution): The AI’s Guaranteed Receipt. This is Warden’s most critical feature for building trust. While most financial AI requires blind trust, SPEX changes this by using cryptographic verification to prove exactly which AI model ran and what data it used for its recommendation, solving trust issues and eliminating “AI washing” in automated finance.

- Multichain Support: Agents can manage portfolios across Ethereum, Polygon, Algorand, and others. For the investor, this means your AI agent can manage all your digital investment accounts from one place, overcoming today’s fragmented RWA environment.

- Secure Agent Identities: Agents have cryptographically secured identities capable of holding tokens and signing transactions independently. This allows them to act as truly autonomous, trusted managers.

Specific Use Case: AI Agent Managing Your RWA Portfolio

Monday Morning, 8 AM: Your AI agent has been busy overnight scanning your 15 tokenized real estate properties.

Discoveries:

- Property #7 (a Cleveland duplex on RealT) hasn’t paid rent twice in a row.

- Property #12 (a Phoenix home on Lofty) increased its yield from 8.2% to 9.1%.

- A new high-yield Madrid apartment listing just appeared on Reental.

Actions Taken by AI Agent (The Technical Details):

- Sends you an alert recommending investigation or sale of Property #7.

- Analyzes portfolio impact if Property #7 is sold and Madrid apartment purchased.

- Calculates trading fees and determines the 9-month break-even point for the rebalancing.

- Recommends holding Property #7 for 30 days to monitor payments before rebalancing (executing the trade).

You make the final decision—but the AI completed analysis in 10 seconds instead of you taking 2 hours. This level of intelligent portfolio management will become standard as RWA investing matures.

Current Status Reality Check & Risks

While Warden showcases credible tech, it is a brand-new project and must be approached with caution.

Technology Risks (What Could Go Wrong with the Code)

- AI hallucinations: Even verified AI can err if using flawed or misinterpreted data.

- Unproven smart contract security: If the underlying code has an exploit, your funds could be locked or stolen.

- Cross-chain bridges add attack surfaces, which hackers frequently target.

- Scalability is unknown for $100k+$ active AI agents; speed could become an issue.

Company Risks (Will Warden Succeed?)

- Warden is new: Long-term success, despite a strong team, is unproven.

- Ambitious roadmap amidst a market where the majority of new crypto projects fail.

- Strong competition from 50+ other AI crypto platforms, including giants like Fetch.ai.

- The $WARD token economics (how the platform’s currency works) are still unproven and highly volatile.

Market Risks (Will Real Estate Platforms Adopt This?)

- Adoption is theoretical: Platforms like Lofty and RealT must choose to integrate Warden or its competitors. They could build in-house solutions.

- Regulatory uncertainties remain the largest long-term hurdle for tokenized RWAs.

How Should Investors Approach This New Technology?

For the everyday person, the risk is high, but the trend is important to monitor.

Option 1: The Wait-and-See Approach (Recommended for 90%)

- Action: Bookmark Warden’s website and check quarterly. Monitor news about RWA platform integrations.

- Investment: $0 | Risk: None

- Best for: Most investors, especially those with less than $10,000 in RWA holdings.

Option 2: The Low-Risk Experiment (Recommended for 9%)

- Action: Use the Warden app with a small amount of capital (e.g., $50–100). Test AI agent features and join the community to learn the mechanics.

- Investment: $50–200 | Risk: Low

- Best for: Tech-savvy investors who already hold $10,000+ in RWAs and want hands-on experience.

Option 3: The High-Risk, Small Bet (For <1%)

- Action: Small speculative holdings of the $WARD token only. Engage actively with the community and beta tests. Prepare for a potentially total capital loss.

- Investment: $500–2,000 | Risk: Very High

- Best for: High-risk crypto natives with strong conviction and capital they can afford to lose entirely.

Conclusion: The Inevitable Convergence

Three powerful trends are unfolding: Tokenized RWAs will grow dramatically (supported by major players like BlackRock), portfolio complexity will increase across multi-chain holdings, and AI agents like those on Warden Protocol will automate this complexity.

Warden showcases a strong team (Ex-Binance, Ex-Google) and promising early traction—but as of 2025, it is embryonic with most RWA integration still theoretical. Most investors should monitor, not invest. By 2028–2030, agent-managed portfolios will likely be standard. The future of automated RWA management is clear, whether on Warden or its competitors.

⚠️ Important Disclaimers 🛑

- This is educational content, not financial advice.

- Warden Protocol is new and unproven. The $WARD token is highly speculative; you may lose value or lose everything.

- RWA integrations are theoretical; they may never materialize.

- Invest only what you can afford to lose completely.

- Consult licensed advisors before investing.

Sign up for more educational articles and alpha from RWApedia.org:

Leave a Reply