Quick Answer: Centrifuge is a legitimate real-world asset (RWA) platform with $1.33 billion in total value locked and partnerships with major institutions like Janus Henderson. It’s safe for sophisticated investors comfortable with private credit, but recent token dilution and the November 30, 2025 migration deadline create short-term risks. Best for: Experienced DeFi users seeking high-yield private credit exposure. Not for: Complete beginners or those wanting simple treasury yields. For more insights, check this Centrifuge Review Crypto.

What is Centrifuge?

Centrifuge is a blockchain platform that tokenizes real-world assets (RWAs), specializing in private credit – loans, mortgages, invoices, and other debt-based investments that traditionally only institutions could access. This innovative approach is explored in detail in the Centrifuge Review Crypto.

Think of it this way: Instead of just tokenizing simple U.S. Treasury bonds (like competitors do), Centrifuge handles complex financial products like:

- Invoice financing for businesses

- Mortgage pools

- Credit card receivables

- Even S&P 500 index funds

Founded: 2017

Blockchain: Originally Polkadot, now migrating to Ethereum and Layer 2 networks

Token: CFG

Current TVL: $1.33 billion

Headquarters: Berlin, Germany. For an in-depth examination, refer to our Centrifuge Review Crypto.

How Centrifuge Works (Simple Explanation)

Here’s the step-by-step process:

Step 1: A business (like a mortgage lender) wants to get immediate cash for their loans instead of waiting years for repayment.

Step 2: They create a Special Purpose Vehicle (SPV) – a legal entity that holds these loans separately. This protects investors if the business goes bankrupt.

Step 3: Centrifuge converts these loans into digital tokens using their Tinlake platform.

Understanding the dynamics of this platform can be enhanced by reading the Centrifuge Review Crypto.

Understanding the dynamics of this platform can be enhanced by reading the Centrifuge Review Crypto.

Step 4: Investors buy these tokens and earn interest as borrowers make payments.

Step 5: The platform splits investments into two types:

- DROP tokens (Senior/Safe): Lower risk, lower returns – you get paid first if things go wrong

- TIN tokens (Junior/Risky): Higher risk, higher returns – you absorb losses first but earn more

This is called “tranching” and it’s how Wall Street has structured debt for decades – Centrifuge just brought it to crypto.

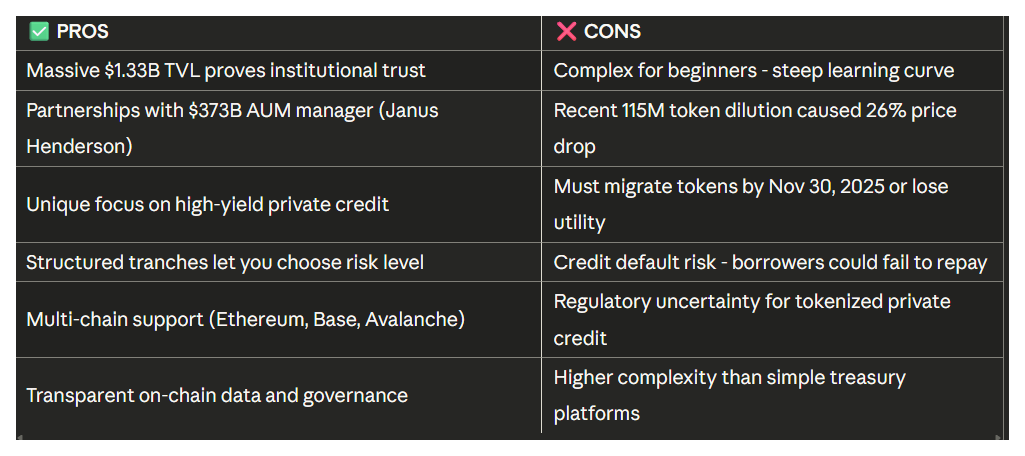

✅ Pros and ❌ Cons

Is Centrifuge Safe?

Short answer: Yes, but with important caveats.

Security Measures ✅

Legal Structure: Every asset pool requires an SPV (Special Purpose Vehicle) – a legal wrapper that isolates assets. If the original business fails, investors still have legal claim to the underlying loans.

Smart Contract Audits: Centrifuge’s V3 infrastructure has been audited, though the multi-chain architecture using Wormhole bridges does increase attack surface compared to single-chain platforms.

Regulatory Compliance: Major products like the Janus Henderson S&P 500 fund (SPXA) are fully licensed and regulated.

Track Record: Operating since 2017 with zero major hacks or exploits.

Risk Factors ⚠️

Credit Risk: The biggest danger is that underlying borrowers default on their loans. While DROP tokens have first-loss protection from TIN tokens, a severe economic downturn could impair both tranches.

Complexity Risk: Private credit is harder to understand than U.S. Treasuries. You need to evaluate each pool’s underwriting quality.

Migration Risk: The platform is moving to a new technical infrastructure. If you don’t migrate your tokens by November 30, 2025, you’ll lose governance rights and liquidity.

Smart Contract Risk: Multi-chain systems using bridges (Wormhole) create more potential vulnerabilities than simple single-chain platforms.

Is Centrifuge Legit?

Yes. Here’s the proof:

Institutional Validation

- Janus Henderson Partnership: $373 billion asset manager committed up to $250M into Centrifuge’s AAA-rated CLO fund (JAAA)

- S&P 500 Index Fund: Licensed tokenized SPXA fund – the first on-chain S&P 500 fund

- $1.33B TVL: Real institutional money deployed, not just retail speculation

Team & Background

- Operating since 2017 (7+ years)

- Based in Berlin with transparent team

- Active governance with regular community votes

- Open-source code on GitHub

Red Flags? None Major

- ✅ No history of rug pulls or exit scams

- ✅ Transparent tokenomics and governance

- ✅ Real products with real institutional users

- ⚠️ Recent token dilution is controversial but transparently communicated

Verdict: Centrifuge is one of the most legitimate RWA platforms, but the complexity means it’s not for everyone.

Centrifuge Fees and Costs

| Fee Type | Typical Amount | Notes |

|---|---|---|

| Platform Fee | 0.4% – 4% annually | Varies by pool and asset type |

| Asset Originator Fee | 2% – 10% | Paid to the business originating loans |

| CFG Gas Fees | ~$0.01 – $0.50 per transaction | Low on native Centrifuge chain, higher on Ethereum |

| No Redemption Fee | $0 | Free to withdraw (subject to pool liquidity) |

Example: If you invest in a pool with 8% APY and 2% total fees, your net return is 6% APY.

Comparison to competitors:

- Lower than: Traditional private credit funds (often 1-2% management + 20% performance fee)

- Higher than: Simple treasury platforms like Ondo (typically 0.15-0.40%)

Minimum Investment & Requirements

Minimum Investment

Varies by pool: Typically $1,000 – $10,000 minimum depending on the specific asset pool.

Example minimums:

- Some pools: $1,000

- Institutional pools: $10,000+

- Direct CFG token purchase: Any amount (but often $100+ practical minimum after gas fees)

Requirements

✅ What you need:

- Ethereum-compatible wallet (MetaMask, WalletConnect)

- Complete KYC (Know Your Customer) verification

- For some pools: Accredited investor status (depends on jurisdiction and pool)

🌍 Geographic restrictions:

- Not available: U.S. residents for most pools (SEC regulations)

- Available: EU, UK, Asia (varies by pool)

- Check specific pools: Each investment has different compliance requirements

💡 Tip: Non-accredited investors CAN buy the CFG token itself, but many investment pools require accredited status.

Yields and Returns

Current Yields (October 2025)

Typical returns by pool type:

Pool TypeTrancheTypical APYRisk LevelInvoice FinancingDROP (Senior)6-9%Low-MediumInvoice FinancingTIN (Junior)10-15%Medium-HighReal Estate LoansDROP (Senior)7-10%MediumReal Estate LoansTIN (Junior)12-18%HighInstitutional CLO (JAAA)Single tranche5-7%Low (AAA rated)

Performance notes:

- Returns are paid in stablecoins (USDC typically)

- APYs fluctuate based on borrower repayment rates

- Historical default rates have been low but vary by originator

vs. Alternatives

Higher yields than:

- U.S. Treasury bonds (4-5%)

- Ondo USDY (4.5-5.5%)

- Traditional savings accounts (3-4%)

Similar to:

- Traditional private credit funds

- Hard money lending

Risk-adjusted: Centrifuge offers institutional-grade private credit returns without requiring $1M+ minimums typical of traditional funds.

The V3 Migration: What You Must Know

What’s Happening

Centrifuge is moving from its original Polkadot-based chain to multi-chain Ethereum deployment. This includes:

- Ethereum mainnet

- Base (Coinbase’s L2)

- Avalanche

- Other EVM chains

Why It Matters

For Institutions: Access to Ethereum’s deep liquidity pools and familiar tooling makes Centrifuge much easier to integrate.

For You: More liquidity, better DEX integration, and easier trading of CFG tokens.

⚠️ CRITICAL: Migration Deadline

November 30, 2025 – You MUST migrate your old CFG and wCFG (wrapped CFG) tokens to the new EVM-native version.

What happens if you don’t:

- ❌ Lose governance voting rights

- ❌ Lose access to secondary market liquidity

- ❌ Tokens become functionally useless

How to migrate: Visit Centrifuge’s official migration portal (check their website for the exact URL – don’t click random links!)

CFG Token: Utility and Dilution Risk

What CFG Token Does

Governance: Vote on protocol changes, fee structures, and treasury decisions

Gas Fees: Pay for transactions on the Centrifuge chain (minting asset NFTs, etc.)

Staking: Earn rewards by securing the network (coming in future updates)

Tokenomics

Total Supply: 680 million CFG (post-migration)

Recent Controversy: The protocol just approved minting 115 million new CFG tokens for ecosystem development:

- 15M unlocked immediately

- 100M vested over 4 years

The Dilution Debate

Bearish view: 17% supply increase caused ~26% price drop in 30 days. Short-term pain for holders.

Bullish view: These tokens fund developer grants and market adoption. If they help Centrifuge capture more of the $17B private credit RWA market, the long-term protocol revenue far exceeds the dilution cost.

My take: Dilution is real and painful short-term. But it’s strategic investment to compete. If TVL continues growing to multi-billions, the token could significantly appreciate long-term despite the dilution.

Centrifuge vs. Competitors

The RWA Landscape

PlatformFocusComplexityBest ForCentrifugePrivate credit, structured productsHighSophisticated investors wanting high yieldsOndo FinanceU.S. Treasuries, simple yieldLowBeginners wanting safe, stable returnsPolymeshCompliant securities (stocks, bonds)MediumRegulated security issuanceSecuritizeFund tokenization for institutionsMediumAsset managers (BlackRock BUIDL)

Centrifuge vs. Ondo Finance (Most Common Comparison)

Choose Centrifuge if:

- ✅ You want higher yields (8-15% vs 4-5%)

- ✅ You understand structured credit

- ✅ You’re comfortable with credit risk

- ✅ You’re NOT a U.S. resident

Choose Ondo if:

- ✅ You want simple, treasury-backed yields

- ✅ You’re a complete beginner

- ✅ You prioritize safety over returns

- ✅ You’re a U.S. resident (more accessible)

Key difference: Ondo is like a high-yield savings account. Centrifuge is like being a credit investor at a hedge fund.

How to Get Started with Centrifuge

Step 1: Set Up Your Wallet

- Download MetaMask or another Web3 wallet

- Secure your seed phrase (write it down offline!)

- Fund with ETH for gas fees (~$50-100 to start)

Step 2: Complete KYC

- Go to Centrifuge’s official app: app.centrifuge.io

- Connect your wallet

- Complete identity verification (passport/ID + proof of address)

- Wait for approval (typically 24-48 hours)

Step 3: Choose Your Investment Pool

- Browse available pools in the Tinlake interface

- Review each pool’s:

- Asset type (invoices, real estate, etc.)

- APY and fee structure

- Asset originator track record

- Risk level (DROP vs TIN)

- Read the pool documentation (seriously – don’t skip this)

Step 4: Fund Your Investment

- Acquire stablecoins (USDC or DAI typically)

- Send to your connected wallet

- Approve the smart contract (one-time transaction)

- Invest your desired amount

Step 5: Monitor & Manage

- Track your investment in the Tinlake dashboard

- Interest accrues continuously

- Withdraw anytime (subject to pool liquidity)

- Participate in governance votes if you hold CFG

⏱️ Time estimate: 30-60 minutes for first-time setup, 10 minutes for subsequent investments.

Centrifuge Price Prediction 2025-2026

Disclaimer: Price predictions are speculative. Do your own research.

Short-Term (Q4 2025)

Factors:

- Migration completion (Nov 30 deadline)

- Absorbing 115M token dilution

- Market digesting institutional partnerships

Analyst estimates: $0.31 – $0.45

Current resistance: Short-term volatility expected

Long-Term (2026+)

Bull case catalysts:

- JAAA and SPXA funds scale to $500M+ AUM

- Protocol revenue from fees increases dramatically

- New tokenomics (CP171) ties CFG value to revenue

- Private credit RWA market grows from $17B to $50B+

Potential targets: $1.50 – $3.14 (if institutional adoption continues)

Bear case risks:

- Credit defaults in economic downturn

- Regulatory crackdown on tokenized private credit

- Competition from traditional finance entering RWA space

Critical Risks to Consider

1. Credit Default Risk (Biggest Risk)

What it means: Borrowers might not repay their loans.

Why it matters: Unlike treasury bonds backed by governments, these are private loans. If too many borrowers default, you lose money – even DROP holders in severe scenarios.

Mitigation: Diversify across multiple pools, favor established originators, start with DROP tokens.

2. Regulatory Uncertainty

What it means: Laws around tokenized private credit are evolving.

Why it matters: Governments could restrict trading, impose licensing requirements, or ban certain structures entirely.

Mitigation: Stay informed on regulatory developments, diversify geographically, be prepared to exit if laws change.

3. Smart Contract & Bridge Risk

What it means: The new V3 multi-chain architecture uses Wormhole bridges.

Why it matters: Bridges have been hacked before (billions lost). More chains = more attack surface.

Mitigation: Only invest what you can afford to lose, wait for battle-tested V3 deployment before going heavy.

4. Liquidity Risk

What it means: Some pools might not have instant liquidity for withdrawals.

Why it matters: If you need your money immediately and the pool doesn’t have available capital, you might have to wait for borrower repayments.

Mitigation: Check pool liquidity before investing, maintain an emergency fund outside of illiquid investments.

Conclusion: Should You Invest in Centrifuge?

Centrifuge is legitimate, safe (with caveats), and offers unique exposure to institutional-grade private credit that was previously inaccessible to most investors.

Invest in Centrifuge if:

✅ You understand structured credit and risk tranches

✅ You’re comfortable with 6-18% yields backed by real-world loans

✅ You can complete KYC and aren’t a U.S. resident

✅ You’re willing to do homework on individual pools

✅ You believe institutional RWA adoption will continue growing

Skip Centrifuge if:

❌ You’re a complete crypto beginner

❌ You want zero-risk treasury yields

❌ You need guaranteed liquidity

❌ You can’t evaluate credit risk

❌ You’re looking for 50x moonshot speculation

Rating: 8/10 for Sophisticated Investors

Strengths: Proven institutional adoption, unique market position, transparent governance, real utility

Weaknesses: Complex for beginners, recent dilution, migration requirements, credit risk exposure

Bottom line: Centrifuge is building critical infrastructure for the tokenized private credit market. If you understand the risks and can evaluate asset pools, it offers compelling risk-adjusted returns. But this isn’t a “set and forget” investment – it requires active monitoring and due diligence.

⚠️ IMPORTANT REMINDERS

- Migrate your tokens by November 30, 2025 if you currently hold CFG

- Complete due diligence on each pool – don’t blindly invest

- Start small – test with minimum amounts before going heavy

- This is NOT financial advice – always consult a licensed financial advisor

Leave a Reply